Airport Runway Foreign Object Debris Detection System Market To Reach US$ 110.1 Million By 2032

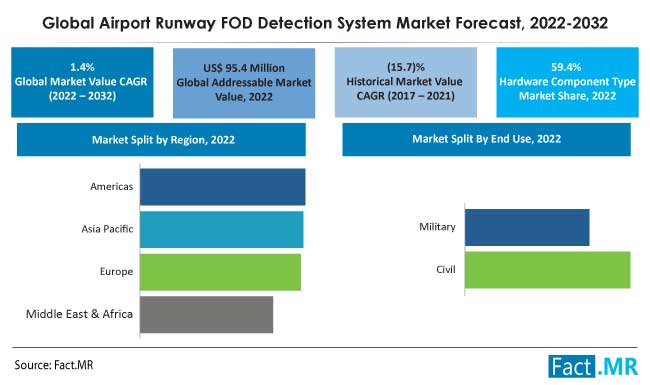

The hardware components of airport runway FOD detection systems are expected to make up 59.4% of total global sales.

ROCKVILLE, MD, UNITED STATES, November 1, 2023 /EINPresswire.com/ -- In 2021, the United States dominated the American airport runway FOD detection systems market, with a market share of approximately 76.5%. The United States is projected to maintain its position as the primary regional market for this technology in the coming years, as per the Fact.MR report.

The worldwide airport runway Foreign Object Debris (FOD) detection systems market size is expected to exceed a value of $95.4 million in 2022 and is projected to contract at a compound annual growth rate (CAGR) of 1.4%, ultimately reaching $110.1 million by the conclusion of 2032.

For more insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=1897

Airport Runway Foreign Object Debris (FOD) Detection System Market: A Rollercoaster Ride from 2017 to 2021

Between 2017 and 2021, the airport runway FOD detection system market experienced turbulent growth, primarily influenced by the Covid-19 pandemic's impact on the travel industry. In 2017, the airport FOD detection systems market held a market value of US$ 103.6 Mn. However, it suffered a sharp decline in 2020, due to the COVID-19 pandemic. Nevertheless, as travel restrictions eased, the industry began to recover, gradually regaining momentum.

Consequently, by 2021, the airport runway FOD detection systems market had rebounded to a market value of US$ 52.2 Mn. Notably, the Middle East and Africa regions emerged as hotspots for potential growth in the airport runway FOD detection systems market. In 2021, the market experienced an impressive year-on-year growth rate of 33.5%.

Key Companies Profiled:

· Xsight Systems Ltd.

· Moog Inc.

· Trex Aviation Systems

· The Stratech Group Limited

· Argosai Technology

· Hitachi Kokusai Electric Inc.

· Pavemetrics Systems Inc.

· Rheinmetall Italia S.p.A.

Driving Innovation and Growth in FOD Detection Systems: A Long-term Perspective

In the foreseeable future, heightened government investments in air defense infrastructure and the ongoing expansion of the civilian aviation sector are expected to have a favorable influence on the adoption of advanced real-time FOD (Foreign Object Debris) detection systems.

- In the short term (from the second quarter of 2022 to 2025), the increasing number of airline travelers is poised to drive the growth of the market for airport runway FOD detection systems.

- Looking ahead to the medium term (from 2025 to 2028), the integration of cutting-edge technologies like UAVs and AI is anticipated to enhance the precision of airport FOD detection systems, thereby mitigating the downward trend in the market.

- Taking a long-term perspective (from 2028 to 2032), enhancements in scanning efficiency, enabling FOD detection systems to identify even the smallest objects, are expected to boost the sales of these devices.

During the historical period from 2017 to 2021, the global market for airport runway Foreign Object Debris (FOD) detection systems experienced a negative Compound Annual Growth Rate (CAGR) of -15.7%. According to market research and competitive intelligence provider Fact.MR, the market is expected to show a positive CAGR of 1.4% from 2022 to 2032.

The accompanying image offers a concise overview of market share analysis for airport runway FOD detection systems, categorized by end use and region. In 2022, within the end-use segment, the civil sub-segment held the dominant position with a 56.9% market share.

Enhancing Efficiency and Precision through Technological Integration

In the early days, Foreign Object Debris (FOD) detection and removal relied on manual human efforts, resulting in a time-consuming process with questionable accuracy. To address this challenge, sophisticated FOD detection systems leveraging advanced technology were introduced. Furthermore, airport authorities worldwide show a strong preference for FOD detection systems incorporating laser and radar technology.

Leading manufacturers of runway FOD detection systems now offer hybrid solutions equipped with built-in cameras and optical radar sensing technology. Artificial intelligence (AI)-powered FOD detection systems possess enhanced image processing capabilities, pattern recognition, robot vision, and deep learning technology, all of which captivate customers and provide an exceptional user experience.

These technological advancements within FOD detection systems are poised to have a positive impact on market growth throughout the forecasted period.

Significant Emphasis on Augmenting Runway Capacity and Operational Efficiency: Affecting the Aviation Market

The aviation industry faces substantial challenges, including indirect costs stemming from flight cancellations and delays, resulting in passenger losses and disruptions to schedules that necessitate crew and aircraft repositioning. In 2021, 121,522 flights were canceled, and a similar trend continued into the first half of 2022, with 3.2% of flights facing cancellations.

In addition to these indirect costs, there are direct expenses related to aircraft maintenance, such as engine repairs, fan blades, and other equipment. For example, engine repair costs due to foreign object damage (FOD) account for just over 20% of the price of a new aircraft engine.

To mitigate these challenges and enhance runway capacity and operational efficiency, the adoption of airport FOD (Foreign Object Debris) detection systems has seen a significant increase. This proactive approach to detecting and removing FOD from airport runways is poised to have a positive and substantial impact on the growth of the global airport runway FOD detection systems market during the forecast period.

The Significance of Proficient Operators/Engineers for the Efficient Functioning of FOD Detection Systems

Inadequate training for operators of specific airport runway FOD detection systems can pose safety risks and lead to flight delays. To ensure the accurate operation of airport runway FOD detection systems, skilled professionals are essential. An imbalance in the supply and demand for trained operators can have adverse effects on market growth. Certifications and relevant experience are prerequisites for employment in certain airport runway FOD detection systems.

Numerous training programs offer licenses for these engineers, as regulatory authorities are compelling end-use companies to adhere to mandatory safety standards. Therefore, prior training and practice are of paramount importance. Otherwise, the potential for accidents increases, and operational efficiency declines, impacting the company's revenue.

The High Expenses Associated with Maintaining Airport Runway FOD Detection Systems

Ensuring the safety of airport runways remains the foremost concern for aviation authorities. Presently, two types of FOD (Foreign Object Debris) detection systems are in use: stationary and mobile. Mobile FOD detection systems offer a more cost-effective alternative compared to their stationary, radar-based counterparts.

Furthermore, for smaller airport runways, the initial investment required to cover the entire runway area amounts to approximately $5-10 million. Subsequently, post-purchase expenditures, including repair and maintenance costs, tend to be substantially elevated due to the utilization of costly radar, camera, and other system components.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=RC&rep_id=1897

Market Competition Overview

In September 2020, Dyer & Butler, a multi-specialty engineering services firm, successfully completed runway maintenance and infrastructure enhancement projects at Gatwick Airport. The scope of their work encompassed the installation of new Foreign Object Debris (FOD) and Instrument Runway Visual Range (IRVR) systems.

As such initiatives proliferate globally, the airport FOD detection system is poised for significant expansion in the coming years.

Fact.MR has recently released a comprehensive report detailing key aspects of the airport runway FOD Detection System market. This report includes information on the pricing strategies of leading manufacturers across various regions, sales growth trends, production capacities, and anticipated technological advancements.

Check out more related studies published by Fact.MR Research:

Airborne Weapon System Market: The global airborne weapon system market was valued at US$ 80.5 Billion in 2021, and is projected to register a Y-o-Y increase of 3.7% in 2022 to be valued at US$ 83.6 Billion. During the 2022-2032 period of assessment, demand is expected to rise at a 3.6% value CAGR, likely to reach US$ 119 Billion by the end of the said forecast period.

Airport Retailing Consumer Electronics Market: The global airport retailing consumer electronics market is estimated at USD 1,880 Million in 2022 and is forecast to surpass USD 3,780 Million by 2032 end, growing at a CAGR of 7.2% during 2022-2032.

About Us:

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client’s satisfaction.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.